A few days back Treasury Wine Estates made an announcement that left me in shock. Figuring that they collectively contribute less than 5% of the company’s net profit, it has decided to ditch three once-massive Australian wine brands plus a once-substantial US cheap frills brand. So, to all realistic intents and purposes, it’s vale to Lindemans, Wolf Blass and Yellowglen. Plus Blossom Hill, which perhaps fortunately remains outside the experience of most Australian wine drinkers. That announcement should be accompanied by a thunderclap.

One of the reasons I feel so affected by this news is that I have or had personal connections with each of the three Australian brands whose life support has just been turned off.

My first job in wine production was for Lindemans. In the early 1980s I did several stints for this company, mainly in its massive Padthaway vineyard, finally graduating to vintage at what was then the Rouge Homme winery in Coonawarra. I don’t know how I managed not to be decapitated by a chainsaw while preparing vines for grafting in Padthaway. While working the aptly named graveyard shift in Coonawarra I once woke up at about 4 in the morning to find myself hanging by my right arm from a pipe above an auger. Despite these occupational near-misses I developed a deep affection for the Lindemans brand and the people who worked for it. I ran with them, played cricket with them and enjoyed testing the company product with them. The connection remains.

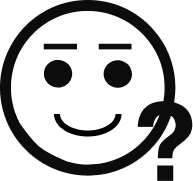

I first met Wolf Blass in early 1984 when I dropped into his office trying to get the company to stock and sell copies of my first book, Thirst for Knowledge, through their cellar door. Wolfie could not have been more encouraging or inspiring. And so began what has become a 40-year fascination of this remarkable individual – one of only a few to bend the Australian wine industry to his will. Without Wolfie’s relentless drive, thermonuclear energy, straight-talking ebullience – each of which enabled him to connect with virtually anyone - this industry would look rather different. If only it had a leader with a fraction of the incredible Wolf Blass mojo today. He was both inspirational and supportive towards me as a critic. If you knew your stuff and stuck with the truth, you never had a problem with this remarkable guy.

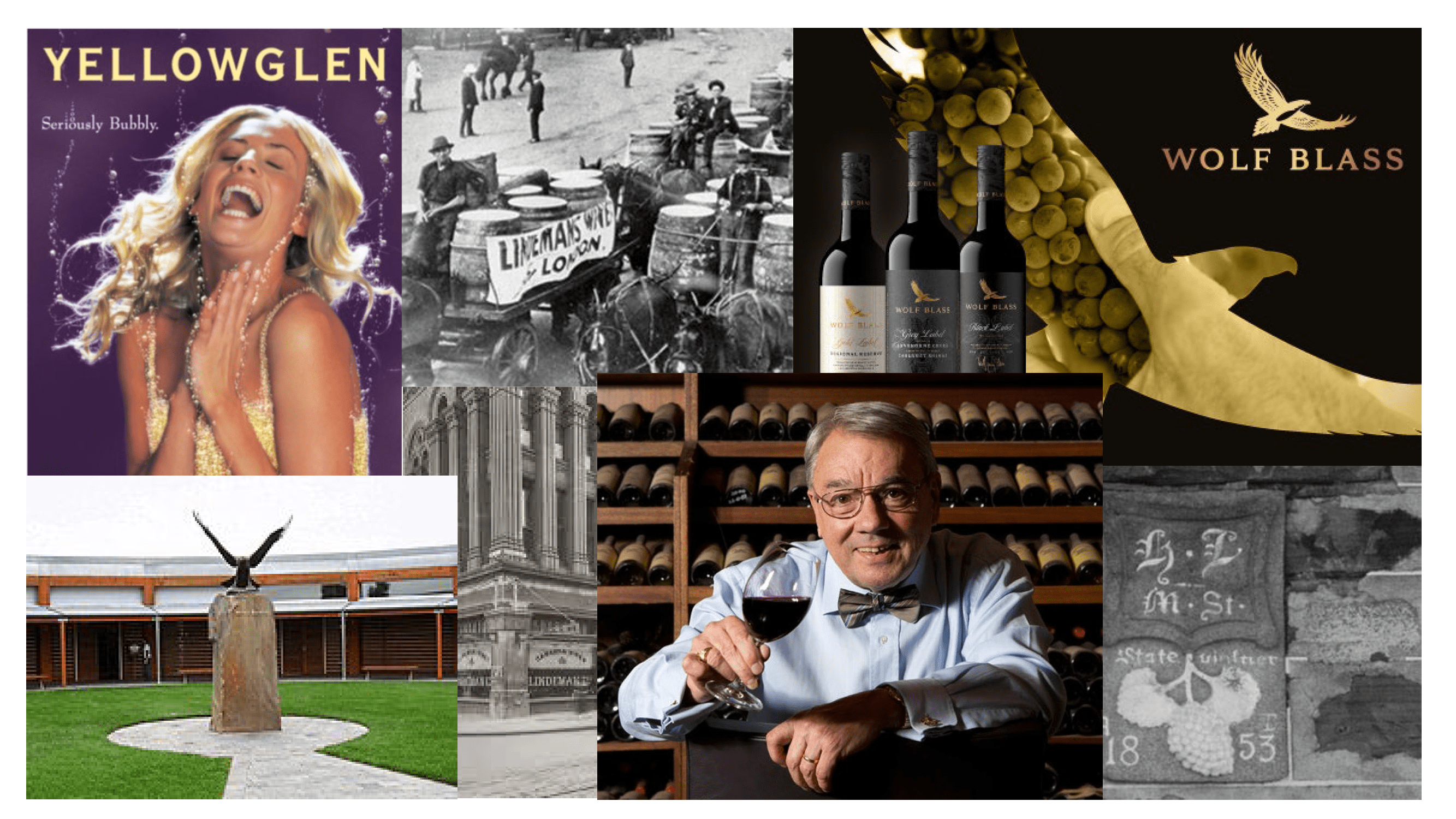

While I came to know Ian Home, founder of Yellowglen at Smythesdale near Ballarat, we were never close. A number of my good friends were indeed close with Ian, who always struck me as a wonderful bloke. However, for a number of years I was indeed friends with another significant name in the Yellowglen story: the very polished, funny, exceptionally intelligent and capable winemaker brought into the company by Ian Home from Champagne: Dominique Landragin. Dominique, whose wife Anna was surely at least a duchess in a previous life, is one of life’s more unforgettable characters.

Throughout the late 1970s and early 1980s, while I was getting started in wine, there wasn’t a more significant Australian wine brand than Lindemans. Its depth and range were massive. For a time it was at least the equal of Wynns in Coonawarra in terms of impact in that region, while its Karl Stockhausen-inspired Hunter classics from shiraz and semillon were properly revered. Its Padthaway white wines were running off the shelves and its inexpensive Bin wines were regarded as something rather superior for their price.

When Lindemans was sold by Phillip Morris to Southcorp in 1990 it suddenly became stablemates with Penfolds. To be honest, nobody thought twice about that, since back then Penfolds comprised but a tiny number of different and almost exclusively red wines. While Grange occupied an increasingly rare and iconic space, the brand and was still in recovery mode from the change in taste away from South Australian red wine that led to that State’s vine pull scheme in the early 1980s.

Circumstances changed in 2005, when Foster’s Brewing bought Southcorp, completing a deal that united five massive brands – Wolf Blass, Penfolds, Seppelt, Lindemans and Rosemount – into a single portfolio. This recent calamity was set in motion long ago.

Meanwhile, the Wolf Blass brand was adding layers to its structure of different-coloured labels, although the number of wines it housed didn’t quite match what Lindemans was or what Penfolds has since become. With its easily understood and prominent branding, its consistent and reliable quality and style, Wolf Blass became for a period the most valuable wine brand in Australia.

Flicking through the internet I stumbled upon this video about Wolf Blass (in which I participated), which might give you an idea what the brand used to be.

While all this was going on, Rosemount began its nosedive. From being one of the most visible, highly reputed, sought-after and most profitable wine brands anywhere, it never really found a home or an identity within the biggest and hottest cauldron ever of major Australian wine labels. Looking back, it was the canary in the coalmine.

Yellowglen, which Ian Home introduced to Australian wine drinkers as a serious contender to Champagne, steadily and irreversibly morphed into a fashion label. For a time it was outrageously successful as the definitive Australian party wine. When TWE switched horses from Seppelt to Yellowglen for its Spring Racing Carnival publicity, it delivered a blow to the heart of Seppelt – Australia’s former market-leader in sparkling wine – but put Yellowglen in front of the party crowd. For a while it was on every bus-stop in the country, or so it seemed. But such brands succeed only when they’re promoted, heavily. Turn off the tap and people gravitate towards something else.

Michael Clarke, TWE’s then CEO, decided around 2017 to devote virtually 100% of the company’s marketing budget to Penfolds. This was hot on the heels of Penfolds’ dramatic sales growth in China which had led to significant price hikes as well as massively increased profitability. Before and throughout this period we saw an expansion of the Penfolds range into virtually every conceivable style of wine that South Australia could produce. Plus some bizarre China-focused concepts of packaging and product which include a cynical mix of shiraz port with baijiu (the indigenous Chinese spirit). Not to mention the G3, about which I have written elsewhere.

However, it was patently obvious to anyone paying attention that Clarke’s decision would shape, or indeed seal, the fate of the other brands within the TWE camp. We are now witnessing the inevitable consequences of that act. While there’s no doubt that shareholders have benefitted from this process, the decision to offload these brands closes the door on much of Australia’s wine history and tradition. And yes, while it is of course the job of the CEO of publicly listed companies to maximise returns to investors, maybe the true impact of the collateral damage will only be appreciated in future, several financial cycles away.

All of which makes you wonder what might have happened instead had China not taken en masse to the Penfolds brand, whose name in Chinese means ‘running to money’. Perhaps, had similar fortune been bestowed upon Wynns, Seppelt or Lindemans, the company might look quite different today.

Ian Home is no longer with us and other than the recent occupant of the winemaking chair, there’s really nobody left within TWE who identifies with Lindemans anymore. However – and this is where my thoughts turned immediately on hearing the news – around the age of ninety Wolf Blass remains more or less exactly what he has been for the last half-century and more. He’s sharp, healthy, active and totally on the ball.

So how is he taking the demise and sale of the Wolf Blass brand? Fortunately, the news is good: he’s taking it much, much better than I dared to imagine. Pragmatic as ever, he recognises the inevitability of the situation and resolved long ago that Clarke felt he was acting in the best interests of his shareholders. I can’t tell you how relieved I was to hear this. In truth, if Wolfie ever mourned the fate of his brand and his life’s work, it happened long ago.

The world awaits pending developments within the TWE boardroom. What will be the ultimate fate of once-proud brands such as Wynns Coonawarra, Seppelt, Saltram, Leo Buring and Coldstream Hills? We’ve also seen the recent demise of several significant Australian labels within the Accolade folio, but this didn’t stop this company from picking up the local wine assets of Pernod Ricard. Will they do a better job with Jacob’s Creek than they have done with the rest of their folio? Will they make a bid for Wolf Blass? Let’s wait and see.

The evolution of Australian wine continues at a pace that is both frenetic and unpredictable. What will the industry look like in five years from now? What other brands will join the increasingly long rollcall of the dearly departed? Is it right to mourn the loss of heritage brands that had already lost their identity? Maybe not. But it’s certainly right to reflect on the traditions and reputations that are simply erased from the record after the boardroom culls.

After all, it’s wine we are talking about – not Coca-Cola.