This is the original text of a speech I gave at the Agribusiness Summit staged by the Australia China Business Association in Melbourne on June 21, 2023. Please note the important footnote (asterisked) which concerns the potential timing of the removal of the tariffs on Australian wine sales to China.

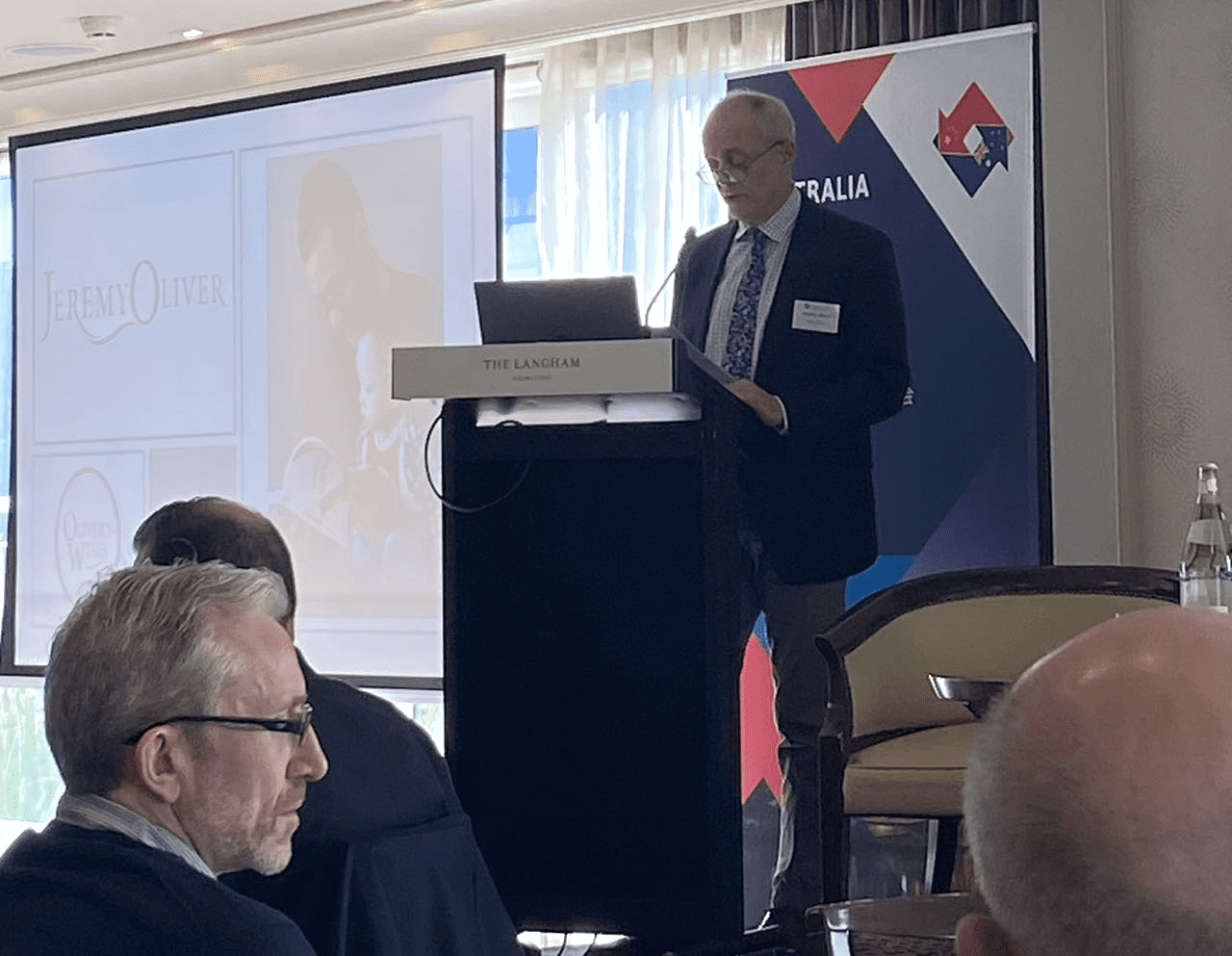

Distinguished guests, ladies and gentlemen, it’s a delight to be here today to discuss the case study of Australian wine in China. This is a subject I know a little about, having been personally involved in the development of this market. Over 65 trips across 16-17 years I was fortunate to host many hundreds of educational and promotional events for Australian wine, to publish six wine books in Chinese – none of which, incidentally, I can actually read – and to host four top-rating online TV series educating the China market about wine. I have fronted trade missions on behalf of the Federal and Victorian Governments and have been introduced to literally thousands of Chinese wine enthusiasts.

I’m a wine critic and presenter, and I’m proud to be the first westerner to have written a book about wine for the Chinese market to be published in their own language. I’m deeply committed to engagement between our countries and I look forward to the day when we will see again Australian wine occupying a strong position within China.

I am shortly to launch a new online platform of my own in Australia which will be also published in Chinese, and feature a retail store within WeChat. I’m certainly not here today as an armchair critic. I’d also add that while everything I’m about to say is based on fact, the opinions I’m about to offer are mine alone. So you can relax, Virginia…

The theme of this event is A Fresh Start. It goes without saying that Australian wine growers would welcome the opportunity to re-engage with their former buyers in China.

Australian wine has long promoted its innovation, technology and sustainability, each of which is critical when you’re trying to make money out of winegrowing while living on the world’s oldest and driest continent, and when many of your key customers inhabit the other side of the planet. Australian wine producers are ready to go again, but this time around it’s not about promoting their proven innovation, technology and sustainability. Of far greater import is the necessary sense of political surety and confidence – from governments on both sides.

For years Australia has been making far more wine than it can sell – about 40% if truth be told. China’s emergence as a market for our wine simply placed a Band-Aid over this reality. The Chinese government is not responsible for our current over-supply. If I were to remove between one third and half of the grapes used for wine production in Australia – with the proviso that I could choose which to take out – two things would happen. Firstly, hardly anyone whose vineyard was not uprooted would notice, and all of a sudden it would again become profitable to make wine in Australia. And the industry would be less dependent on exports to survive.

Chinese people love wine. With a culture steeped in the understanding of food, tea and natural harmony, Chinese represent the fastest-learning wine drinkers in history. A long time ago – on a Sunday I think – I met a young Chinese wine lover at a tasting in Beijing. He spoke with unusual eloquence of the balance shown by a wine I had just poured. I asked him how old he was, and despite appearing younger, he claimed to be 18. I then asked how long he had been drinking wine. He told me 15 days. Rest assured, Chinese wine enthusiasts are very real, they’re very fast to learn, and they’re totally different from ours over here.

Chinese drinkers love Australian wine. You don’t develop a export market worth $1.5 billion in just over a decade in a community that resists your product. Despite the difficulties of the past three or so years, there are still Australian winemakers working in China to improve local Chinese wine, just as there are many Chinese vineyard and winery owners in Australia who are now deeply entrenched in our local wine industry. And they are not the only ones who are hoping for a resumption of wine trade to mainland China, which currently stands at a token $11 million. Without access to mainland China, Australia’s annual wine exports are now lagging at a mere $1.9 billion.

I’m fully aware of the current expectation that China might roll back the 200+% tariffs on Australian wine, even if I don’t understand why it would. There’s just too much well-sourced information on this subject to ignore. Expectations are that it might happen as early as the end of this year, or early next. Without notice. Or indeed it might not. We won’t know until it happens, if indeed it does. My guess, for what it’s worth, is 2025.*

What are Australian wine brand owners to do? If trade can resume on a pre-tariff basis, could Australian wine depend on China to the same extent for its future success? My answer here is no, for at least the short to medium term. On this note, I feel strongly that the hundreds of wine makers and growers, whose livelihoods were treated by the Australian government like pawns on a chessboard, deserve to be told the truth.

The elephant in the room behind Australia’s success in the China wine market was what is known as ‘immigration wine’ – wine exported to China by Chinese citizens seeking PR in Australia through a range of business migration schemes operated by Australian State Governments, most of which have been very significantly scaled back. I believe this avenue accounted for around 55% of Australia’s previous wine revenue from China. If that’s close to correct, that reduces future potential sales to China to about $700 million.

Next, consider that the wine market inside China has declined over recent years – by 30-50% between 2018 and 2022 – depending on whose numbers you’re looking at. Wine had become a huge part of China’s on-premise dining, banqueting and gifting culture, each of which have declined. Young Chinese people are today experimenting with flavoured drinks, non-alcoholic beverages (including those which started life as wine) and spirits. There’s a massive uptake in the sales of traditional Chinese spirits, each at the expense of the market share wine had gained. That reduces our best target to perhaps $400 million or so.

Then, factor in that Australia’s once-pre-eminent place in China has been aggressively divided by countries like South Africa, New Zealand, France, Spain and Italy to name a few. Will they stand idly by while Australia waltzes back in through the front door? No way. Right now there’s a massive global oversupply of wine and of course they will defend their turf.

Perhaps, therefore, we are talking about regaining a market that could sustain sales of $200 million, enough still to list China amongst Australia’s top three export markets for wine.

This problem of scale is not Australia’s alone. China’s own wine industry, which is today very substantial, has plummeted in production, sales and profitability. Today China produces roughly two-thirds less of the wine volume it made in 2014.

Recently, Australian companies have tried to retain market share in China through diverse and bizarre means, none of which have achieved any measurable success. You can export wine in bulk to China, have it bottled there and sold under your own label. There’s an inherent risk in this approach, mainly because Chinese consumers prefer to buy Australian wine bottled under Australian quality control processes. The bulk wine trade to China is currently languishing at less than $4 million, according to Wine Australia.

Alternatively, you can put your wine into 3-litre bottles, which are not identified under current tariff arrangements. This format is hardly handy for individuals or couples, and has actually been subject to long-term delays with China Customs.

Amazingly, there are still buyers in China prepared to pay the full tariff, in advance, so some companies have tried this tactic. Surprisingly, there are still shipments of fully paid-up wines sitting at Chinese ports for many months, in entirely unrefrigerated conditions.

You can make wine for your brand from Chinese vineyards, which Penfolds are currently trying. Over recent years this company has attempted to disprove the notion that wine is unlike Coca-Cola – and that all you need to do is replicate a recipe to grow and make it anywhere in the world and customers will fall for the switch. I can’t see this approach working in the more sophisticated Chinese cities, but perhaps in some of the cities still discovering wine? I doubt it, but who knows? The key issue is that many Chinese consumers are still sceptical about food and drink products grown in China and prefer to buy imported.

Some brands have tried making their wine from grapes grown in neither Australia nor China, only to hope that the Chinese consumer then fails to detect the change of origin. I warn against this, since to fail to respect the intelligence of Chinese wine buyers is a risky approach, and it’s wise to understand as much as possible about the drivers of their purchasing behaviour.

It is still possible for Australian wine to enter China through more porous locations along its border. Our wine exports to Hong Kong currently stand at $182 million – about half that of the UK and the US. And there’s no way most of that wine remains for long in Hong Kong. If you’re looking for an answer to the question of how Penfolds, Auswan Creek and Yellowtail somehow remain amongst the top 10 wine brands sold on Jindong, perhaps this is it.

Should Australian wine again be given the chance to compete in China, it will best succeed if its growth is sustainable, and built upon the genuine desires and needs of consumers, rather than handy loopholes and entirely unrelated trends and issues like immigration.

Should this happen, there’s a genuine opportunity to build a substantial, profitable and long-term market in China. For unquestionably, there is still residual market and brand awareness for Australian wine in China, alongside positive consumer sentiment. Despite the current tariffs, you can still find and buy half-decent Australian wine without difficulty in most major Chinese cities. It still has a place on most serious restaurant lists.

With the depressing market conditions now facing Australian wine, an export market worth $200 million that’s ready to go would be a lifeline for hundreds of producers. I sincerely hope there’s truth in the rumours we hear, which then translates into an opportunity for the hard-working families, both Australian and Chinese, whose livelihoods were ruined by their own elected representatives.

Thank you.

* After a discussion with an attendee at the Agribusiness Summit, I do now see a powerful reason why China might remove the tariffs on Australian wine imports sooner than later. I have not altered my speech to reflect this, since I don’t like that kind of post-edit, but I would not now be surprised to see the tariff removal coincide with the conclusion of a very high-level meeting in China between the top officials of both our countries.